Tax Planning Strategies of an Offshore Trust Explained

Tax Planning Strategies of an Offshore Trust Explained

Blog Article

Understand the One-of-a-kind Benefits of Utilizing an Offshore Trust for Global Asset Defense

When it concerns guarding your possessions, recognizing offshore counts on is essential. These economic tools can give a layer of protection versus legal cases and political instability. You could be stunned by how they can boost your privacy and deal versatile asset monitoring options. What precisely makes overseas counts on an engaging selection for those looking to safeguard their riches? Allow's explore the distinct benefits that might transform your financial technique.

What Is an Offshore Trust?

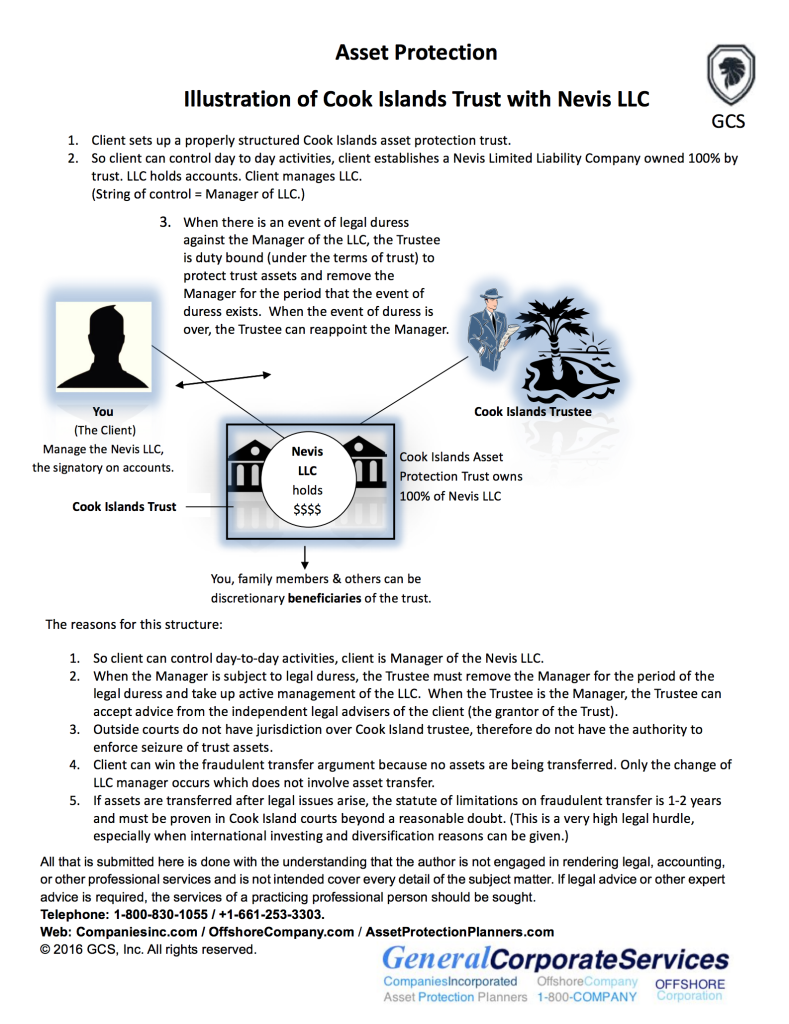

An overseas Trust is a lawful setup where you move your assets to a count on based in a foreign country. This arrangement enables you to handle and shield your wide range while potentially appreciating tax obligation advantages and personal privacy. By placing your possessions in an overseas Trust, you separate your personal possession from the properties, which can give you with better control and adaptability in managing your investments.

You can designate a trustee, who will look after the Trust and assure it runs according to your instructions. This plan can be especially helpful if you have worldwide ties or plan to travel frequently, as it can streamline the management of your assets throughout boundaries.

Furthermore, overseas depends on commonly include rigorous discretion laws, enabling you to maintain your monetary affairs exclusive. Overall, using an overseas Trust can be a calculated relocation for those seeking to enhance their asset monitoring and protection on a worldwide scale.

Asset Defense From Legal Claims

Offshore depends on give considerable asset security from legal claims, guarding your riches against possible claims and creditors. By positioning your possessions in an offshore Trust, you create an obstacle that makes it harder for complaintants to access your riches. This added layer of protection can deter pointless lawsuits and provide you assurance recognizing your hard-earned properties are safe and secure.

In many territories, offshore depends on enjoy solid lawful structures that prioritize the privacy and protection of your possessions. This means that also if you deal with legal challenges, your Trust's properties are frequently protected from seizure - offshore trust. Additionally, the separation of lawful possession from valuable possession can make complex efforts by lenders to reach your assets

Ultimately, utilizing an offshore Trust not only secures your assets but additionally allows you to concentrate on what genuinely matters, without the consistent fear of prospective legal insurance claims endangering your financial stability.

Protecting Riches From Political Instability

When political instability endangers economic safety and security, using an offshore Trust can be a clever relocate to protect your wealth. By placing your possessions in a territory with secure political and financial conditions, you can shield your investments from prospective government seizures or unfavorable regulations in your house nation. Offshore depends on provide a layer of security that aids assure your riches stays intact during turbulent times.

Additionally, these trusts can be structured to give flexibility in just how and when you access your possessions, allowing you to adapt to changing scenarios. You can dictate terms that prioritize your financial health, assuring your resources aren't at risk from neighborhood political turmoil.

Additionally, offshore trust funds can assist you diversify your investments around the world, spreading danger across various markets. This technique not only guards your riches but additionally improves potential development, allowing you to weather political tornados with greater self-confidence.

Privacy and Confidentiality Perks

Boosted Possession Secrecy

Just how can you guarantee your possessions stay personal in an increasingly transparent globe? Utilizing an overseas Trust can substantially improve your asset secrecy. By putting your wide range in a trust developed in a territory with strong privacy legislations, you create a barrier versus spying eyes. This arrangement allows you to manage your possessions without them being straight linked to your name.

In addition, overseas trusts typically don't require public enrollment, meaning your economic information remain personal. You'll take advantage of the competence of experts that comprehend regional policies and can navigate the complexities of asset defense. By doing this, you can keep your personal privacy while safeguarding your riches from prospective risks, making sure that your financial tradition stays discreet and safe.

Lowered Public Disclosure

When you develop an offshore Trust, you can maintain your economic affairs out of the public eye, protecting your possessions from prying eyes. Unlike onshore counts on, which frequently call for comprehensive disclosures, offshore trusts normally include marginal reporting demands.

In addition, the jurisdictions where offshore depends on are established commonly have strict privacy legislations, even more securing your monetary info. By making use of an offshore Trust, you're not simply protecting your wealth; you're likewise making sure that your financial decisions stay personal, allowing you to handle your properties without unnecessary scrutiny or interference.

Legal Security Approaches

Establishing a lawful structure around your offshore Trust can significantly boost your personal privacy and discretion. By establishing an offshore Trust, you create an Read More Here obstacle between your assets and prospective plaintiffs. This separation guarantees that your monetary info stays protected from public scrutiny, providing you assurance.

Furthermore, lots of jurisdictions offer rigid privacy legislations that safeguard your financial and personal information. This means less opportunities of undesirable exposure or legal obstacles. You additionally obtain the capacity to designate a trustee that can handle your properties quietly, even more ensuring your information stays private. In general, leveraging these legal protection methods not only fortifies your property safety and security however likewise allows you to preserve control over your financial tradition without unnecessary interference.

Versatility in Possession Monitoring

While navigating via the intricacies of global property management, you'll locate that versatility is crucial to enhancing your overseas Trust. This versatility permits you to respond promptly to changing scenarios, whether they're economic shifts, legal growths, or personal goals. You can adjust your financial investment techniques, allot assets in varied territories, or also change trustees to better line up with your goals.

Moreover, overseas trusts commonly provide various financial investment alternatives, enabling you to expand your profile while mitigating risks. You can tailor your depend fit your certain requirements, from adding or getting rid of beneficiaries to modifying circulation terms. This degree of customization not only improves your control over your properties yet also guarantees that your financial methods advance as your life circumstances change.

Ultimately, the flexibility intrinsic in overseas depends on encourages you to make educated choices that guard your wide range in an unpredictable world.

Possible Tax Obligation Benefits

When considering international possession administration strategies, potential tax obligation benefits typically pertain to the leading edge. Using an offshore Trust can supply you with numerous benefits that may help minimize your tax responsibilities. By positioning your possessions in a trust located in a beneficial jurisdiction, you may capitalize on reduced tax obligation rates and even tax obligation exceptions.

Lots of offshore jurisdictions supply eye-catching tax obligation incentives, which can bring about considerable cost savings. For instance, some may not enforce funding gains or estate tax, enabling your wide range to grow without the concern of substantial tax obligation commitments. You'll likewise enjoy the adaptability to structure your Trust in a manner in which lines up with your economic goals.

Maintain in mind, however, that conformity with worldwide tax obligation legislations is crucial. You'll require to stay notified to guarantee your offshore Trust remains certified and advantageous. On the whole, an offshore Trust could be a wise step for enhancing your tax obligation situation.

Selecting the Right Territory for Your Trust

Choosing the ideal territory for your Trust can substantially influence its effectiveness and your overall financial technique. Some places use strong possession security legislations, which can secure your assets from creditors.

Next, think of the political and financial security of the location. A secure environment reduces dangers related to currency fluctuations or changes in law. Additionally, assess the management needs. Some territories might have intricate regulations that can complicate your Trust administration.

Ultimately, take into consideration the track record of the jurisdiction. A well-regarded location can offer credibility to your Trust, making it much easier for you to work with financial establishments. By very carefully examining these variables, you can choose a territory that lines up with your asset protection objectives.

Often Asked Inquiries

Just how much Does It Cost to Establish an Offshore Trust?

Establishing up an offshore Trust commonly costs in between $2,000 and $10,000, depending upon intricacy and jurisdiction. You'll wish to consider recurring charges for discover this info here maintenance and compliance, which can include in your overall costs.

Can I Manage My Offshore Trust Remotely?

Yes, you can handle your overseas Trust from another location. Numerous trustees supply on the internet accessibility, allowing you to supervise investments, make choices, and communicate with your trustee from anywhere, ensuring you remain in control of your properties.

What Kinds Of Properties Can Be Placed in an Offshore Trust?

You can place different assets in an offshore Trust, consisting of cash, property, financial investments, and service interests. Each property kind provides special benefits, assisting you expand and protect your riches properly.

Are Offshore Trusts Legal in My Country?

You should inspect your nation's regulations concerning overseas counts on, as legitimacy differs. Several countries recognize them, however details regulations may apply. Consulting a legal professional can supply quality customized to your situation and jurisdiction.

Just how Do I Pick a Trustee for My Offshore Trust?

Selecting a trustee for your overseas Trust entails looking into trusted companies or individuals, reviewing their experience, recognizing costs, and guaranteeing they straighten with your objectives. Reliability and interaction are essential for effective administration of your assets.

Final thought

In final thought, using an overseas Trust can be a game changer for your worldwide possession security technique. By separating ownership from assets, you gain robust defense from lawful cases and political instability. And also, the personal privacy and versatility these counts on offer can significantly boost your monetary administration. With potential tax benefits and the best jurisdiction, you can develop a safe and secure atmosphere for your riches. Think about an offshore Trust to secure view it now your properties and guarantee assurance.

An offshore Trust is a legal setup where you move your properties to a depend on based in a foreign nation. By putting your possessions in an offshore Trust, you separate your individual ownership from the possessions, which can offer you with greater control and versatility in managing your financial investments.

In lots of jurisdictions, offshore trusts appreciate strong lawful structures that focus on the privacy and protection of your possessions. When you develop an offshore Trust, you can maintain your financial events out of the public eye, protecting your possessions from spying eyes. Unlike onshore counts on, which usually need thorough disclosures, offshore trusts normally involve marginal coverage requirements.

Report this page